Take our simple questionnaire to help you decide if bankruptcy is right for you. If you’re reading this, chances are

Financial Tips, Bankruptcy, Bankruptcy News Posted on Jun 18, 2019

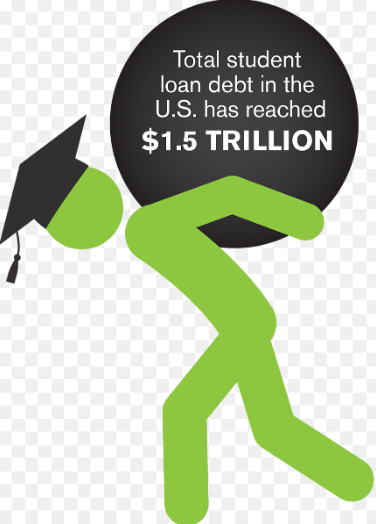

In the past 10 years, 8.7 million bankruptcy petitions were filed in the federal courts under Chapter 7, also known as liquidation bankruptcy. Of those, 2.8 million petitions—32 percent—carried student loan debt. Why is this significant? Student loan debt is almost impossible to eliminate in bankruptcy. Given a fallacy in the law, student loan debt is viewed as debt that does not qualify for financial relief, such as credit card debt or foreclosures. Likened more to child support, student loan debt can only be discharged if paying back the student load causes “undue hardship” to the individual.

Chapter 7 bankruptcy discharges most unsecured debt. This includes credit card debt, medical bills and personal loans. It is the quickest, simplest and most common type of bankruptcy because it gives debtors a “fresh start.”

For your student loan debt to be wiped out in Chapter 7 bankruptcy, you must convince a judge that repaying your debt will cause you undue hardship. This is a challenging process. To determine if repaying a debt will cause “undue hardship,” the judge will apply the Brunner Test—a three-part evaluation that is extremely hard to pass. If you meet the following three requirements, your student loan debt may be dischargeable under Chapter 7 bankruptcy:

Courts rarely discharge student loan debt in bankruptcy; however, whether you qualify for a hardship discharge ultimately depends on the individual circumstances of your case.

If you believe you meet all three requirements of the Brunner test, your next step would be to contact a bankruptcy attorney. Although not necessary, having the guidance and expertise of an experienced bankruptcy attorney will significantly increase your chances of successfully wiping out your student loan debt. Discharging student loan debt is referred to as an adversarial process—it requires full-scale litigation that not all bankruptcy attorneys practice. Bankruptcy litigation is driven by individual facts and circumstances of the debtor and it can be grueling. The more evidence there is of hardship, the easier things are. The more speculative the hardship, the more work to be done by the lawyer. Experienced bankruptcy attorneys are more apt to discharge student loan debt.

If you’re facing unimaginable debt, talk to a knowledgeable bankruptcy attorney at the Law Firm of Hoskins, Turco, Lloyd & Lloyd. Led by bankruptcy attorney Colin Lloyd, our bankruptcy department has helped thousands of Treasure Coast businesses and families regain a fresh start. We offer free consultations so you can learn what can be done to eliminate your debts. Call 866-460-1990 or visit the contact page.

Take our simple questionnaire to help you decide if bankruptcy is right for you. If you’re reading this, chances are

When you’re facing financial stress, the idea of filing for bankruptcy can feel overwhelming. At Hoskins, Turco, Lloyd & Lloyd,

While the holidays can bring joy, they can also lead to financial stress if not managed carefully. Here are 7

Phone: (772) 344-7770

Fax: (772) 344-3838

Phone: (772) 464-4600

Fax: (772) 465-4747

Phone: (772) 577-7551

Fax: (772) 794-7773

Phone: (863) 357-5800

Fax: (863) 763-2237

As the law firm Florida has trusted for over 40 years to fight on their behalf, we are more than ready to represent you. Put our experience and reputation to work. If you need help with any legal matter, whether it’s a personal injury, workers’ compensation, disability or bankruptcy case, contact us now. The consultation is absolutely free.

Get the answers you need. We’ll review your case today, for free.

"*" indicates required fields