Auto Accident Settlement

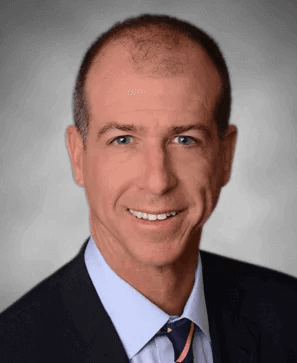

Attorney Colin Lloyd: Let’s start by changing the way you think about the word “Bankruptcy”

Before you can consider whether Chapter 7 or Chapter 13 is right for you, first must change the way you perceive the word “Bankruptcy.” Declaring bankruptcy is not about failure or embarrassment, Bankruptcy is about having the wisdom and wherewithal to pursue your rights per the United States legal court system to stabilize your situation and stave off creditors so you can successfully re-start your financial future.

In a Bankruptcy Proceeding, when your financial security is at stake, it is important to hire an experienced and competent bankruptcy attorney to guide the way and ultimately ensure you receive that in which you are legally entitled — A Financial Fresh Start! And when it comes to selecting that attorney, it makes sense to hire a local Bankruptcy Attorney, such as Colin Lloyd, who has the legacy, experience, and resources to fight for your future.

Bankruptcy is the legal means by which an individual or incorporated business reduces or completely eliminates financial obligations, thereby providing a Fresh Start. The Courts understand that financial hardships exist, often at no fault of the individual, and allows debts to be eliminated, reduced, or simply provide time to catch up on missed payments.

Bankruptcy — Understanding the facts and fallacies.

It is a major misconception that if you file bankruptcy you will lose your house, your car and it will destroy your credit. These are all misconceptions and an experienced bankruptcy attorney can ensure that the Court will not seize your assets and oftentimes credit scores increase after filing for bankruptcy protection.

Bankruptcy can be a complex process, and with many years of experience as a bankruptcy attorney here in Port St. Lucie, Vero Beach, Fort Pierce, and Okeechobee, Colin Lloyd has the expertise to guide you through this difficult time. And because your financial outlook is at risk, we provide FREE same-day consultations so you can learn your options and start looking forward to your financial future.

Which form of Bankruptcy is right for my situation?

Chapter 7 (Liquidation) – A Chapter 7 Bankruptcy is the most common and traditionally what most individuals believe to be a bankruptcy filing. In Chapter 7, most debts are immediately discharged within a few months of filing bankruptcy. The Court does restrict the number of assets an individual may protect before being required to turn over such unprotected assets to the Court. An experienced bankruptcy attorney at our firm will carefully review your assets to ensure that this does not happen without your consent prior to filing the bankruptcy petition.

Chapter 13 (Reorganization) – A Chapter 13 Bankruptcy is where an individual proposes a payment plan with the Court whereby payments are made on a monthly basis to the Court. The Court does not seize assets, rather allows an individual who has more assets than can be protected to voluntarily set up a payment plan to keep those assets. The Court additionally allows an expanded or Super Discharge in a Chapter 13 Bankruptcy where certain debts that are nondischargeable in Chapter 7 can be discharged.

It is often possible to eliminate a 2nd Mortgage on an individual’s homestead real property and/or reduce the mortgage on a piece of non-homestead real property to fair market value. This mortgage modification allows individuals to eliminate tens of thousands, even hundreds of thousands of dollars more than they ever believed was possible. An experienced bankruptcy attorney is critical to have on your side to ensure you maximize the benefit of your bankruptcy filing.

How do I Know if I Need to File for Bankruptcy?

The questions that are often asked by consumers who are considering filing bankruptcy are; How do I know if I need to file bankruptcy? What happens if I do file bankruptcy? Will my credit still be in good shape in a few years? How much will it cost me to go through this process?

Bankruptcy is a very complicated process and the decision to file for bankruptcy should not be taken lightly. When someone is seeking advice on how to handle their debt situation they naturally would want to find the answer to the many questions that will arise through the process. To better understand the process, take a look at this in-depth discussion on knowing whether you need to file for bankruptcy.

Which form of Bankruptcy is right for my situation?

There are several different types of bankruptcies that a person could choose from and each has its own pros and cons. Knowing the differences between the different types will help you choose the best option that fits your circumstances.

It is often possible to eliminate a 2nd Mortgage on an individual’s homestead real property and/or reduce the mortgage on a piece of non-homestead real property to fair market value. This mortgage modification allows individuals to eliminate tens of thousands, even hundreds of thousands of dollars more than they ever believed was possible. An experienced bankruptcy attorney is critical to have on your side to ensure you maximize the benefit of your bankruptcy filing.

Does Bankruptcy Require Me to go to Court?

Are you nervous about going to bankruptcy court? You’re not alone. Bankruptcy court is not a fun time, it’s a very stressful time and you don’t want it to be one of the reasons why you lose your home or your car. Bankruptcy can be scary, especially if you don’t know what is coming, but it doesn’t have to be. Here are some tips that will help you make sure that you’re going to be able to overcome your fear of going to bankruptcy court.

At Hoskins, Turco, Lloyd & Lloyd our experienced team of Bankruptcy attorneys, led by Bankruptcy Attorney and Partner Colin Lloyd, have helped thousands of clients make a fresh start and get back on their financial feet. During your complimentary bankruptcy consultation at any of our offices in Port St. Lucie, Vero Beach, Fort Pierce, and Okeechobee we’ll sit down with you and take the time to discuss the personalized Bankruptcy or Foreclosure option that best fits your particular scenario. And we have developed customized payment plans which are also tailored to your specific financial situation.

To schedule your complimentary consultation with Colin Lloyd Bankruptcy Attorney in Port St. Lucie, Vero Beach, Fort Pierce, or Okeechobee, call 866-460-1990 or visit the contact page.

We are a debt relief agency and attorneys. We help people file for Bankruptcy relief under the Bankruptcy Code. The hiring of a lawyer is an important decision that should not be based solely upon advertisements. Before you decide, ask us to send you free information about our qualifications and experience.

What Our Clients are Saying

Verdicts and Settlements

$1.2 Million

$1.6 Million

Wrongful Death Settlement

$11.1 Million

Settlement for motorcycle accident

Locations

Ft. Pierce, FL 34950

Suite 203, Port St. Lucie, FL 34986

Okeechobee, FL 34974

Vero Beach, FL 32960

The hiring of a lawyer is an important decision that should not be based solely upon advertisements. Before you decide, ask us to send you free written information about our qualifications and experience.

We are a debt relief agency and attorneys. We help people file for Bankruptcy relief under the Bankruptcy Code. The hiring of a lawyer is an important decision that should not be based solely upon advertisements. Before you decide, ask us to send you free information about our qualifications and experience.

Hoskins, Turco, Lloyd & Lloyd © 2020 All Rights Reserved. Terms of Use and Privacy Policy

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.